How to Do Taxes?

- How to Do Taxes?

- Software

- Forms

- Filing deadlines

- Calculating your tax bill

When it comes to doing your taxes, you may be wondering how to do them. Here is a step-by-step guide to filing your federal income tax. The instructions for each form walk you through the steps, explain what information is needed, and provide example applications. These instructions also contain worksheets that can help you calculate whether you are eligible for certain tax credits or deductions. Read them carefully to ensure you understand how to fill them out correctly.

Software

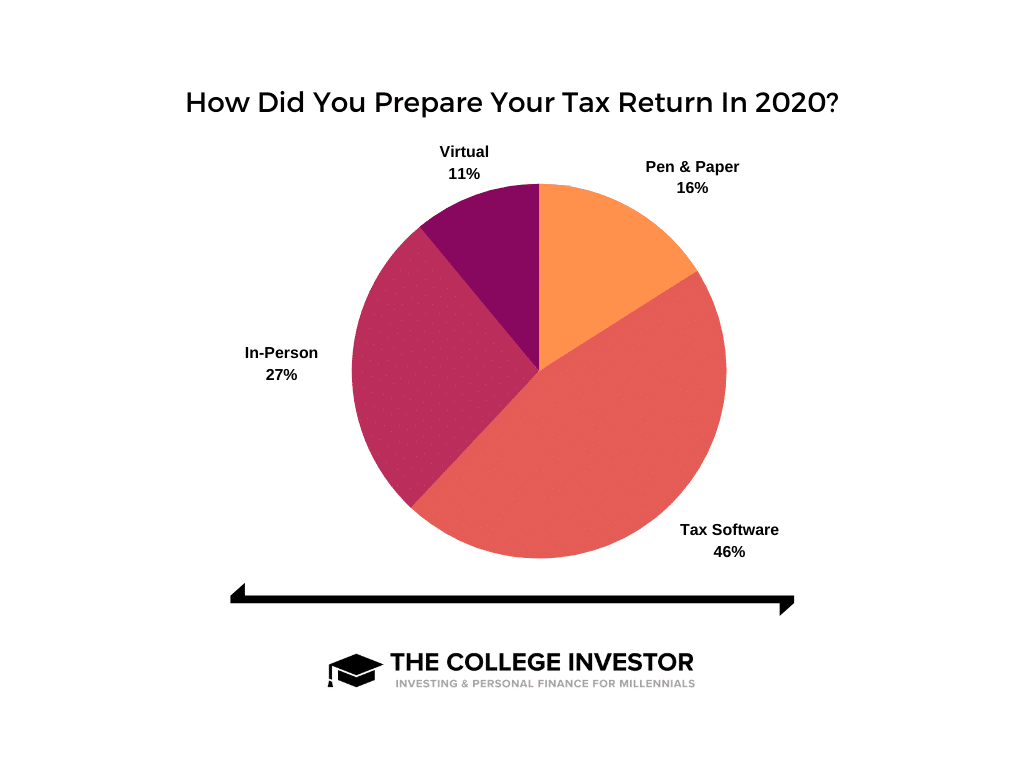

The software that you use for doing taxes can make your life much easier. It does the bulk of the work for you, saving you money on tax professionals. Most of the software requires you to answer questions about major life events and input data from the relevant forms. Some tax software doesn’t require any knowledge of taxes, so even people who don’t understand the nuances of taxes can use it. Choosing the best software for you will ensure you file your taxes correctly and save you time and money.

Most tax software is easy to use, with forms that are straightforward and easy to follow. It even guides you through complex forms, such as work-at-home deductions and unemployment income notations. There are many different types of tax software available, ranging in price and complexity. Here is a list of the top options for doing your taxes. All software should meet the same basic tax filing requirements, but some will handle more complex returns than others.

Forms

There are many forms that need to be filled out when you are doing your taxes. The most important ones are Form 1040 and W-9, which are used for self-employment, income not subject to withholding, and acquiring secured property. The forms that you use to do your taxes may vary depending on your age and gross income, so you should check what form is appropriate for you. The forms can also vary for those who have no taxable income and wish to claim various expenses.

The most common form for doing taxes is Form 1040. It’s used to file annual income tax returns, and it helps determine how much you owe in taxes. It contains questions regarding your personal information, filing status, amount of withholding, income sources, and dependents. You can use tax software to fill out this form for you. Listed below are some of the most common forms for doing taxes. If you’re not sure what type of form you need, take a look at these useful tips.

Filing deadlines

Typically, the tax filing deadline is April 15th. However, if this date falls on a weekend, the deadline is pushed back to the following business day. This year, the IRS didn’t extend the deadline because Emancipation Day was celebrated in the District of Columbia on April 15th. Since April 15 also marks the end of slavery in the United States, the IRS could not mandate that all taxpayers file by April 15th. Instead, the deadline was extended to April 18, the next business day.

In some states, the tax filing deadline is slightly different from federally set deadlines. For example, Maryland extended its deadline to July 15, 2021, while Hawaii didn’t. So it’s important to check with your state’s tax deadlines when looking at tax software. Otherwise, you’ll be surprised at how many options you’ll have to choose from. Here are some examples of tax deadlines:

For military personnel and resident aliens, the due dates are June 15 and Sept. 15. If you’re a U.S. citizen or a nonresident alien, you’ll have to file Form 1040 and pay any taxes, interest, or penalties due. The due date is also extended four months for armed forces personnel and military service members. The IRS has put together helpful resources to help you with the tax filing process.

The IRS has some special rules for extending tax deadlines for Americans who are serving abroad in a combat zone or other contingency operations. Depending on the circumstances, your tax filing deadline may be extended to April 18 or October 17 if you meet one of the conditions. However, it’s crucial to keep in mind that the IRS doesn’t automatically grant deadline extensions – and you’ll be penalized if you don’t file your return on time.

Calculating your tax bill

The tax rate you are charged depends on the value of your home. In most jurisdictions, market value is used to determine your tax bill, and the government will authorize a department to assess that value. This figure will reflect what you can sell your property for when you decide to sell. However, many jurisdictions use an assessment value instead, which is a percentage of the market value. Depending on your property, the rate that applies to you could be higher or lower than market value.

The tax rate you are charged depends on the value of your home. In most jurisdictions, market value is used to determine your tax bill, and the government will authorize a department to assess that value. This figure will reflect what you can sell your property for when you decide to sell. However, many jurisdictions use an assessment value instead, which is a percentage of the market value. Depending on your property, the rate that applies to you could be higher or lower than market value.

The amount of your tax bill may vary, especially if you live in a state that allows residents to view their bills online. Some cities even have their tax bills available online for residents to see at any time. However, it is essential that you understand the tax calculation formula and when it is due to ensure you pay the right amount. Understanding property tax billing cycles and rates will help you avoid any surprises. The tax rates and due dates are an important part of the entire process.

After determining your AGI, the next step is to determine your taxable income. Your tax bill is based on your AGI after you subtract certain deductions. You can take the standard deduction or you can opt to claim itemized deductions. There are even some business owners who can claim a qualified business income deduction. You can also claim a credit to reduce your taxes, if applicable. This way, you can save even more money than you would have otherwise.

In addition to property taxes, you must also pay taxes on school districts and separate levies. Millage rates are a key component of property tax. The millage rate is the amount of tax you must pay on a given $1,000 of home value. Once you have determined your taxable value, you must figure out your tax bill. It is a simple math formula to figure your tax liability. The assessed value of your home is multiplied by the mill rate.