How Much Can I Borrow Mortgage?

- How Much Can I Borrow Mortgage?

- Interest rate

- Loan amount

- Down payment

- Debt-to-income ratio

- Stress test

- Prequalification

Before you apply for a mortgage, it is important to consider your current situation. Your household expenditure, credit history, and the condition of your property will all affect the amount you can borrow. The best way to find out the amount you can borrow is to speak with a mortgage adviser and request a Decision in Principle. A Decision in Principle is a personalised estimate of how much you could borrow. You should note that if you fail to make your repayments, your home could be repossessed.

Interest rate

The interest rate on a mortgage is the amount that the lender charges you to finance your loan. It is an annual percentage rate that is calculated on top of your principal amount. While most mortgages use simple interest, some loans use compound interest. With compound interest, you will pay interest on the principal amount as well as the accumulated interest of previous periods. Low-risk borrowers will receive lower interest rates than high-risk borrowers. Interest rates can also be referred to as annual percentage yields or APYs.

The interest rate on a mortgage is the amount that the lender charges you to finance your loan. It is an annual percentage rate that is calculated on top of your principal amount. While most mortgages use simple interest, some loans use compound interest. With compound interest, you will pay interest on the principal amount as well as the accumulated interest of previous periods. Low-risk borrowers will receive lower interest rates than high-risk borrowers. Interest rates can also be referred to as annual percentage yields or APYs.

The prime rate is an important factor in determining the interest rate on a mortgage. This rate represents the lowest average interest rate that banks are offering for credit. It is used for interbank lending, and lenders use it to determine the interest rate they charge the highest-quality borrowers. The prime rate usually tracks trends in the federal funds rate, which is set by the Federal Reserve.

The interest rate on a mortgage depends on several factors, including the interest rate of the loan, the risk of the borrower, and economic conditions. A low interest rate can mean lower monthly payments, but a high rate can cost thousands of dollars in additional interest over the course of the loan. To get a better idea of how interest rates work, consider an infographic below.

Another factor that affects your monthly payments is the APR. The APR reflects the cost of borrowing the principal amount plus any fees you may be required to pay. If the APR of the loan is greater than the interest rate, then the mortgage will be more expensive than the original amount. Taking the time to calculate the APR of your mortgage is a good way to compare lenders and figure out a price range.

Loan amount

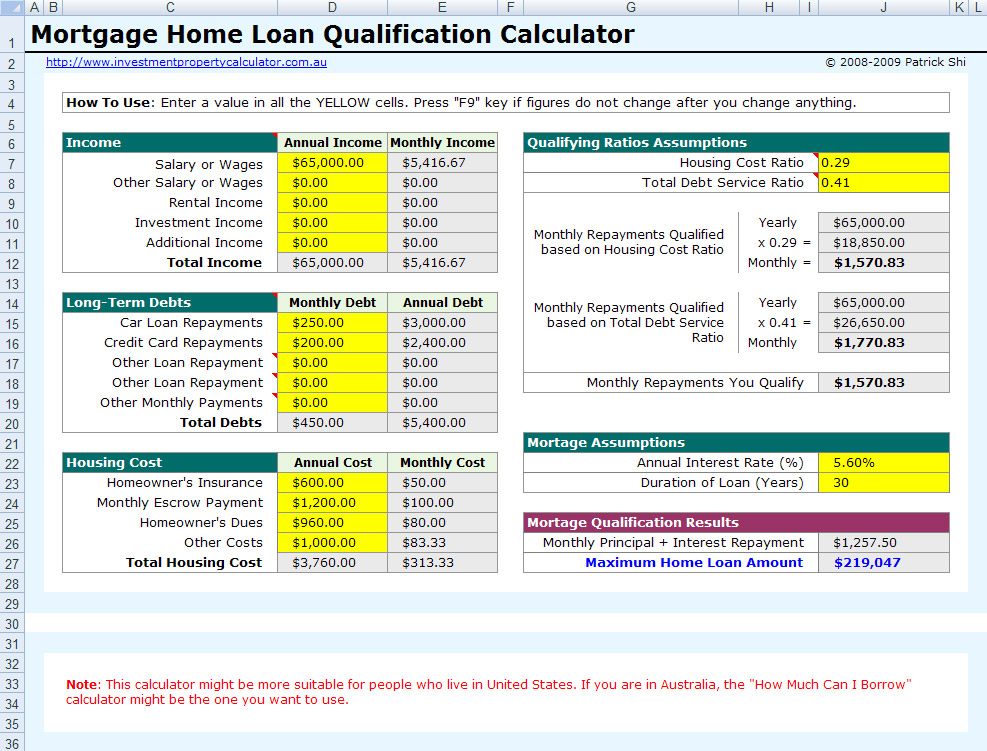

Before you apply for a mortgage, you need to know how much you can afford to borrow. Lenders will consider your current income and your credit history, but they will not consider your future plans. It is advisable to use a mortgage affordability calculator to get a more accurate estimate of your potential monthly repayments.

A mortgage calculator will work out how much you can afford to borrow based on your income and your multiplier. If you are single, you can borrow between four and five times your income. If you have two or more incomes, you can multiply them together for a higher amount. Lenders will also consider your deposit, which will have an impact on how much you can borrow.

Down payment

The down payment on a mortgage is the initial payment a buyer makes to the seller when purchasing a home. It is a percentage of the purchase price and can range anywhere from 3% to 20%. Many first-time homebuyers and repeat buyers can qualify for down payment assistance programs. These programs can help buyers of all income levels and credit scores.

Down payment assistance can take the form of a non-repayable grant or a low-interest deferred-payment second mortgage. You can find more information about down payment assistance programs at the U.S. Department of Housing and Urban Development. There are also several state-level programs available.

Before you start shopping for a mortgage, you should first determine your financial situation. Your income and monthly expenses will play a major role in determining your down payment amount. These expenses may include car payments, insurance premiums, credit card bills, and other debts. Once you know how much you can afford to pay down, you can begin comparing mortgage rates and down payment amounts.

Depending on the down payment you are able to make, you may be able to get a lower interest rate and lower fees. But make sure you know what the fees are before signing anything. Some lenders use large discount points and other hidden fees to lure homebuyers with low down payments. These fees could end up causing you to pay higher interest rates, so make sure you know what you’re getting into before you sign any paperwork.

Debt-to-income ratio

A debt-to-income ratio is a measurement of your financial condition and creditworthiness. It takes into account all of your monthly debt obligations, including your credit card and student loan debt, as well as your car payments and housing obligations. Although lenders generally consider both types of debt-to-income ratios, the back-end ratio is more important.

The ratio is calculated by dividing your recurring monthly debt payments by your gross monthly income. These debts include your car payments, credit card bills, mortgage payments, and rent. You should also include any other debts, including car loans, mortgages, and homeowner’s association fees.

Lenders look at the debt-to-income ratio when determining whether or not you qualify for a mortgage. If your ratio is too high, you might not qualify for new credit or a mortgage. However, if you can make your monthly payments without putting too much pressure on your finances, you should be able to obtain the mortgage.

The first step in buying a home is getting a mortgage approved. In addition to credit score, lenders consider debt-to-income ratio when determining if you are a good candidate for a loan. Your debt-to-income ratio will help you find a home that fits into your budget. You should also consider any student loan debt, as it will affect your ability to obtain a mortgage.

Generally, a debt-to-income ratio of 36% or lower is considered good by lenders. However, many lenders will grant loans with higher ratios. The maximum DTI for a qualified mortgage is 43%, but this number varies from lender to lender. A lower DTI ratio means better chances of approval.

Stress test

Lenders use a stress test to determine your ability to pay back a mortgage. They use the Bank of Canada’s qualifying rate, currently 5.25%, and a number of metrics to determine your affordability. For example, the Gross Debt Service Ratio (GDS) will measure how much of your income you can put toward your monthly mortgage payments. Lenders typically want to see a GDS of no more than 32 percent.

The stress test was designed to ensure that borrowers would still be able to meet their repayments even if interest rates increased. The new rule was introduced by the Financial Conduct Authority in order to encourage lenders to make mortgages affordable for borrowers. “The stress test has made the mortgage market more competitive and made a significant difference to the mortgage market,” says Neal Hudson, a housing market analyst at BuiltPlace.

A stress test is a critical part of mortgage approvals. The test is designed to measure borrowers’ ability to make their monthly repayments and budgeted expenses in an emergency. If the borrower fails the stress test, he or she will not be able to qualify for a mortgage loan. Lenders do not have to apply this test to existing borrowers, but it can have serious consequences for those who fail. Increasing your liquidity, such as by saving more money and reducing other debt obligations such as phone bills and credit card payments, is a crucial part of the stress test.

A stress test affects the affordability of a mortgage by requiring applicants to prove they can meet the minimum thresholds for both the GDS and TDS ratios. A borrower who wants to purchase a home should pay $2440 per month in order to qualify. In addition, it limits how much can a homeowner can borrow.

Prequalification

Prequalification for mortgage is an important first step in the home-buying process. It helps you determine how much you can afford to spend on a mortgage, and it also gives you the chance to shop around for lenders and compare mortgage terms. When you’re prequalified for a mortgage, lenders have verified your information and will lend up to a certain amount, and you can use this document to convince a seller that you can qualify for a mortgage.

A mortgage pre-qualification usually takes about a month, and the time it takes depends on the workload of the lender. You’ll need to submit documents and information to obtain your pre-qualification. However, this pre-qualification doesn’t last forever, because your credit score will fluctuate based on other factors. As a result, your mortgage pre-qualification period may be anywhere from sixty to ninety days.

Prequalification is a good idea for first-time buyers. It will give you an idea of how much you can afford to spend, which will help you narrow down your search. Secondly, it helps you determine whether you can afford to purchase the home you’ve selected. If you are unsure of your credit score, there are several websites that offer free credit checks.

Lastly, pre-qualification for mortgage allows you to get a mortgage faster. Having a mortgage pre-qualification is an effective way to streamline the home buying process and save time. It also shows a seller that you are ready to buy a home and makes your offer more attractive.

We look forward to your comments and stars under the topic. We thank you 🙂