How Much Tax Do I Pay?

Tax day is just around the corner, and people always wonder how much tax they should pay. There is a large debate over who pays the most, and one study by the Pew Research Center found that the wealthy don’t pay their fair share. In fact, 79 percent of respondents said that feeling that the wealthy don’t pay their fair share of taxes bothered them. However, a Joint Committee on Taxation analysis shows that wealthy people do pay their fair share.

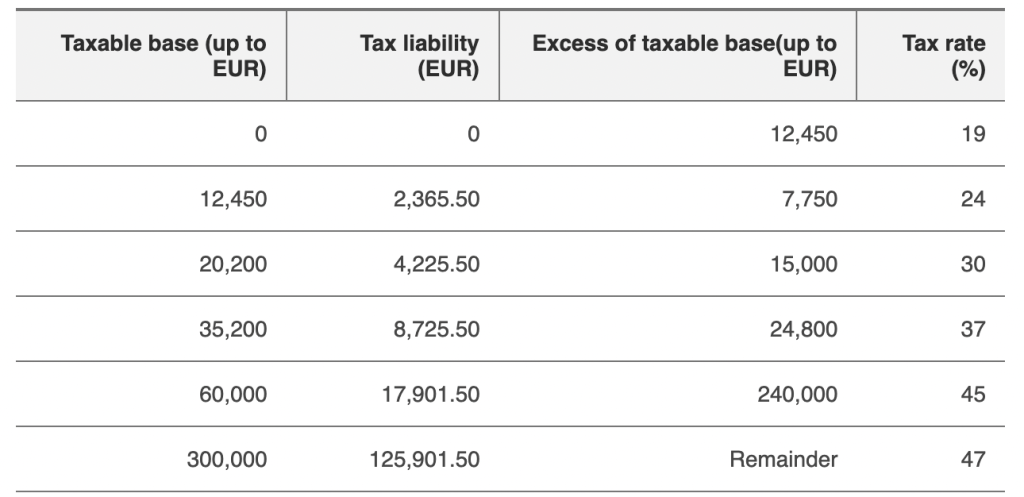

Calculate your tax liability

There are a couple of ways to calculate your tax liability. The first method is to use the IRS Form 1040. Fill out the form with all the necessary information such as taxable earnings and deductions. Once you have the total number, you can add it up to find out how much you need to pay each year. Depending on your income, this amount will vary from year to year.

There are a couple of ways to calculate your tax liability. The first method is to use the IRS Form 1040. Fill out the form with all the necessary information such as taxable earnings and deductions. Once you have the total number, you can add it up to find out how much you need to pay each year. Depending on your income, this amount will vary from year to year.

Your tax liability includes the total amount you owe to the IRS. Most employees pay this amount directly to the IRS, but many companies withhold it from your pay. Fortunately, there are a number of tax credits available to reduce your tax liability. Here are some of them: Employment taxes – this is a form of tax you must fill out each year. You must pay this tax for every employee that you hire. If you are self-employed, you must pay self-employment tax as well. You will also have to pay Social Security tax, which is equal to 12.4% of your wages up to $137,700, and Medicare tax of 2.9% of all wages.

Income Estimates – Estimating income and expenses allows you to make targeted decisions and budget accordingly. You can also make an accurate estimate of your income and expenses each quarter to avoid being surprised by the tax bill at the end of your fiscal year. For example, if your company makes $7,500 in revenue in the first quarter, you can use that as your yearly income estimate. However, if your income changes from quarter to quarter, you may have to adjust your estimates.

Business Tax Liability – The amount of money you owe in taxes is based on your current income. If you operate a business close to the margin, you may have no tax liability. But businesses operating in the black may still have to pay self-employment tax, which is calculated at the same time as your income tax. You can include self-employment tax in your tax liability calculation by multiplying your estimated taxable income by 15.3%.

Tax Laws – The U.S. tax code is complicated, and it can be very difficult to understand. This makes calculating your tax liability an extremely complex process, and it is always best to seek the advice of a professional tax advisor. You should also be aware of any NIIT and alternative minimum tax laws that may affect you.

Business Taxes – For the most accurate tax calculation, you should know the type of business entity you own and its structure. C corporations are different than limited liability companies, which have avoidance provisions that prevent full double taxation. You should know the total amount of revenue based on your sales, investment, franchise fees, potential compensation for patent infringement, etc.

Tax Credits – You can use nonrefundable tax credits to reduce your tax liability. These credits can lower your tax liability to $0, but they cannot reduce it more. Unused nonrefundable tax credits will expire and cannot be carried forward. On the other hand, refundable tax credits allow you to claim the full amount as a tax refund. But they are less common than nonrefundable ones.

Calculate your tax credits

There are a few different ways to calculate your tax credits. Some are refundable, meaning you can get a refund if you do not have enough money to pay the full tax bill. Other credits are nonrefundable, which means you cannot receive a refund. To calculate your tax credits, start by calculating your total taxable income. Then, subtract any standard deduction and any money you’ve already paid in taxes.

In addition to this, you can use the IRS eligibility calculator to get an estimate of how much you can expect to receive. If you are not sure if you qualify, consult an attorney or tax advisor. Some brokers will also help you calculate your credit. If you are a small employer, you can get up to 50% of the total cost of health insurance premiums, and up to 35% of the cost if you are a nonprofit.

You may also be able to get back a portion of the amount you paid in tax in the previous year, but you must confirm that income from the previous year is accurate. Only then will HMRC be able to calculate the correct amount. You should also gather all documents needed for the application. HMRC will ask you to provide copies of these documents.

Before utilizing a tax calculator, be sure to review the terms and conditions of use. The information provided by the calculator is not always accurate. It may be inaccurate or may be outdated. Remember that you should contact a tax professional to determine the most accurate results. You should not rely on it for tax preparation or tax advice.

If you are a low-income taxpayer and have a qualifying child, you may be able to get up to $300 per child. You can still claim this credit, but you have to file your taxes every year to qualify. The credit phases out after your yearly income reaches a certain level. To check if you are eligible for a higher child tax credit, consult the IRS website.

For most tax credits, your annual adjusted gross income is the qualifying amount. If your AGI is over the amount of $80,000, you cannot claim any of the education tax credits. However, you can claim more than one education tax credit if you have the required income. By claiming the right tax credits, you can save hundreds or even tens of thousands of dollars.

Estimate your tax liability for self-employment income

Before estimating your tax liability, consider business write-offs and tax credits. If you’re a college student, for example, your write-offs will be very generous. You might even borrow against next year’s write-offs to cover this year’s expenses. However, remember that write-offs are good for twelve months.

As a self-employed worker, your income is often unpredictable, and this can throw off your self-employment tax estimation. If you find yourself in this situation, make sure to file an amended return with all relevant information. Worksheet 2-10 from Publication 505 can be used to amend the estimation if necessary. Also, make sure to annualize your income if you’re working on a seasonal gig instead of dividing it by four months.

If your net income is $1000 or more, self-employed taxpayers must pay an estimated tax amount every quarter. Self-employed taxpayers can use Form 1040-ES to calculate their estimated tax payments. Estimated payments are based on a formula in the tax code that divides the tax bill into four equal payments. The deadline for filing an estimated tax payment is the first Monday following a weekend.

Self-employed workers can also deduct business expenses, like cell phones and internet. In addition, many contract jobs require steady access to the Internet and a cell phone, which can be leveraged into deductions. Although health insurance premiums aren’t considered operating expenses for self-employed individuals, other expenses that can be deducted from income include software and tech licensing.

Self-employed taxpayers pay taxes on self-employment income in the same manner as regular employees. However, since self-employed workers don’t have a HR department to advise them, it’s up to them to figure out their tax obligations. To help them with their calculations, they can use a self-employment tax calculator.

Self-employed taxpayers must pay 15.3% of their net income for federal taxes. However, this can be difficult to figure without the aid of an outside resource. Failure to pay estimated taxes can lead to penalties and interest. The estimated tax calculator will calculate your tax liability for self-employment income based on your income, deductions, tax credits, and more. The calculator will even help you determine how many payments you should make throughout the year.

Self-employment taxes are paid on net income from your business. If you’re an independent contractor or self-employed shareholder, you will pay Medicare and Social Security taxes. This tax is similar to Social Security withholdings that you have to pay as an employee. Self-employment taxes are required on your earnings, even if they’re small. You must track your income throughout the year and calculate your tax liability to determine your eligibility for benefits.